Permanent life insurance company limited (hereinafter "evergrande life") cutting two "brand" concept.

On October 27, into electronic (002339) publish three quarterly reports show, evergrande life through its two products together share about 4.95%. According to Yuan in shares (300018) three quarterly reports released on the same day, evergrande's life in a similar manner to hold 4.95% shares in the company, approached sign line. However, because the two companies among the top ten shareholders more than half belong to the persons acting in concert, so constant life holdings has no impact on the actual control of the company.

According to the word news, and as of the evening of October 27, in constant life new entrants to the top ten shareholders in the third quarter of the 8 listed companies, the stake is already higher than the 6 4.9%. Li also listed Hunan radio and TV mango TV into

Holding 4.95%, away from 5% of placards line just a step away. In fact, risk capital, as a rule, holdings once they reach the total equity 5% will follow notice disclosure, and cannot sell the stock in less than 6 months. Under 5% ownership control, clearly allows evergrande's life in and out more freely.

Two actual control rights of listed companies are no change

October 27 afternoon, into electronic (002339) publish three quarterly reports, evergrande life through a combination of traditional 10.63 million shares of a holding company, 2.81% became the eighth-largest shareholder's stake in the third quarter. In addition, evergrande's life through the universal combination b 8.13 million shares. At this point, the constant life of its two products together holding into electronic 18.76 million shares, 4.95% per cent of total equity, approach lines.

From the stake, evergrande life total ownership over Yang Zhiqiang, Wang Hao two tied for the largest shareholder. But, in Qian ten shareholders among, first big shareholders Yang Zhiqiang (4.31%), and second big shareholders Wang Hao (4.31%), and fourth big shareholders Wang Liang (4.13%), and v big shareholders strict Chinese (4.13%), and VI big shareholders Feng Dong (4.13%), and seventh big shareholders Sun Heyou (3.02%), and Nineth big shareholders Zhang Zhiwei (2.6%) for consistent action people, total holding proportion reached 26.63%, so product into electronic control right and not on occurred change.

Into e-ten shareholders before the end of the third quarter

Listed in 2010 into e-business covers smart-grid water gas, wisdom, wisdom, intelligence, energy, and information security. Company has made energy, into software product, Qingdao, Shanghai, into, into wisdom set, insight-sec, aotongmai sheng, the product into instruments, xinchengan 9 wholly-or majority-owned subsidiaries, directly or indirectly, shares in more than more than 10 companies. According to the company's three quarterly reports, one to three quarters of this year, the company achieved revenues of 903 million Yuan, an increase of 22.73%, achieving net profit attributable to shareholders of listed companies of 79.6489 million Yuan, an increase of 10.19%.

Similar situation also occurred in shares (300018), according to the company's three quarterly reports issued by the evening of October 27, evergrande life through a combination of traditional 14.19 million shares of a holding company, 2.95% became the eighth-largest shareholder's stake in the third quarter. In addition, evergrande's life through a combination of universal b holds 9.62 million shares of the company. At this point, the evergrande in the life of its two products together holding shares of 23.81 million shares, 4.95% per cent of total equity, approach lines.

But, in Qian ten shareholders among, first big shareholders Deng Zhigang (7.34%), and fourth big shareholders Wang Yongye (5.2%), and v big shareholders Zhang Xiaobo (5.15%), and VI big shareholders Liu Yi (5.05%), and tenth big shareholders Lu Chunming (2.28%) for consistent action people, also, third big shareholders Xu Fuxuan (5.99%) and second big shareholders HAKATA (6.24%) for couple relationship, so constant big life of into temporarily not effect company of actual control right.

Shares in top ten shareholders before the end of the third quarter

80% "sign" associated company shareholders Executive "retreat"

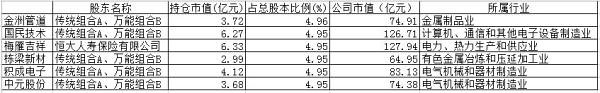

As October 27 evening, three quarter constant big life carrying its products total "associate lift brand" has 6 home listed company, they respectively is Jinzhou pipeline (002443), and national technology (300077), and Meiyan auspicious (600868), and pillars new material (002082), and in the Yuan shares (300018), and product into electronic (002339), holding proportion are in 4.9% above, total positions market about collection 2.711 billion yuan.

As of October 27 and constant life and its products "brand" of listed companies.

Constant life rushing into the top ten shareholders at the same time, the first three quarters of this year, of which 5 are associated with the major shareholders of the company executives were busy selling stock.

According to the universal system, in January 2016, Meiyan lucky 1 executives 265,400 shares of the company's stock holdings.

May 2016, June and September, national technology 2 top executives a total of 64,000 shares of the company's stock holdings.

June 2016, July and September, pillars of new material 7 top executives stock holdings totaling 811,500.

May 2016, July, 5 executives of the share holdings of company stock total 8.9 million shares.

In addition, in September 2016, Kingland pipeline's second-largest shareholder of Beijing rich bloom investment management limited, and 2 Executive total holdings of company stock to 19.3093 million shares.

Earlier, according to securities daily reported that the Treasury Department of the China insurance regulatory Commission officials when referring to finance a total, "said risk capital wants to come in, but as long as you come, industrial feel you are a barbarian, you have to to is to grab my control, or just want to put teams away. "The head of the Treasury Department of the China insurance regulatory Commission said," financial capital on the one hand it is ' wrong ', because in the context of shortage of low interest rates, asset, invest in equity, are allowed. Intensive cultivation, revaluation, improve the corporate governance structure, this is normal. "The people reminded," for risk capital, if you want to enter the capital, to hold large goodwill. "

No comments:

Post a Comment